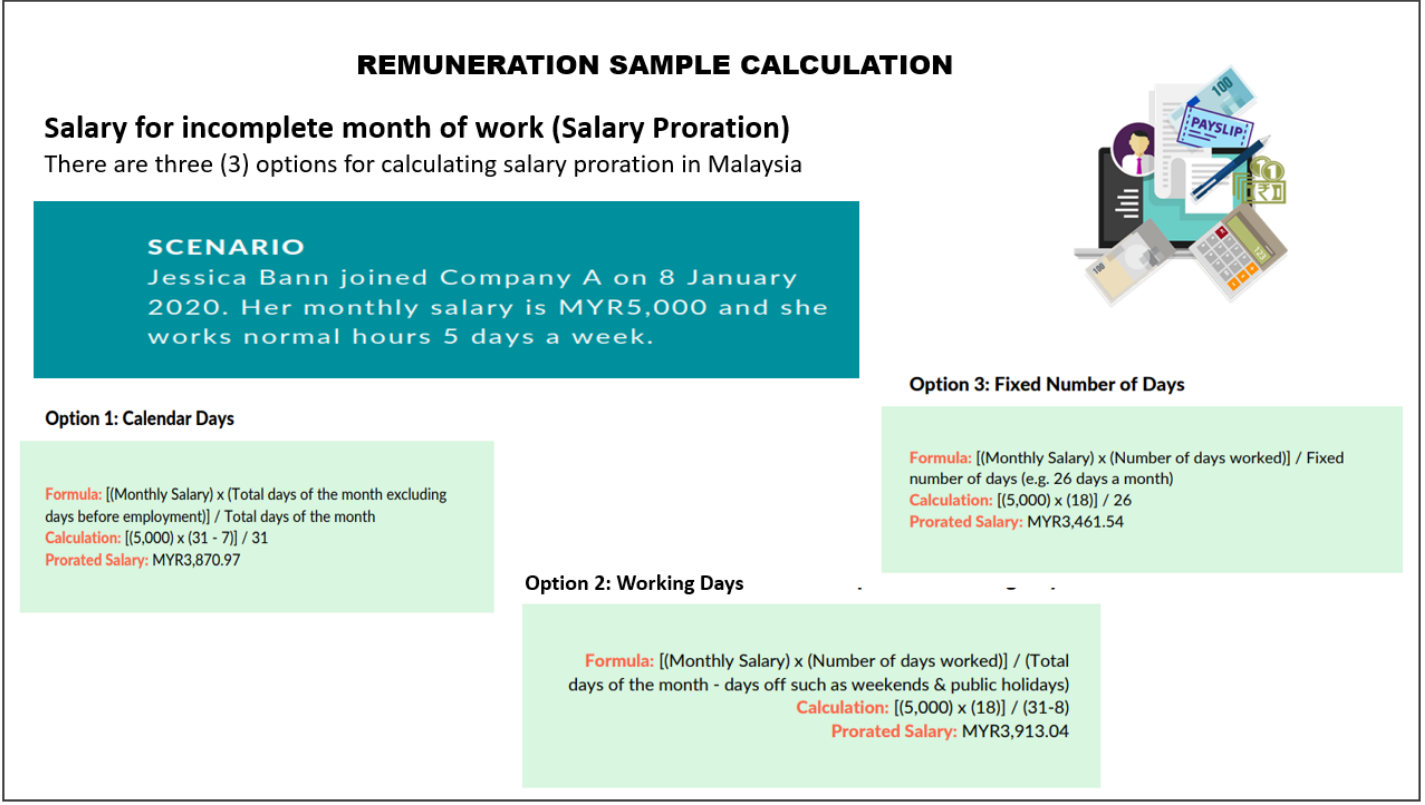

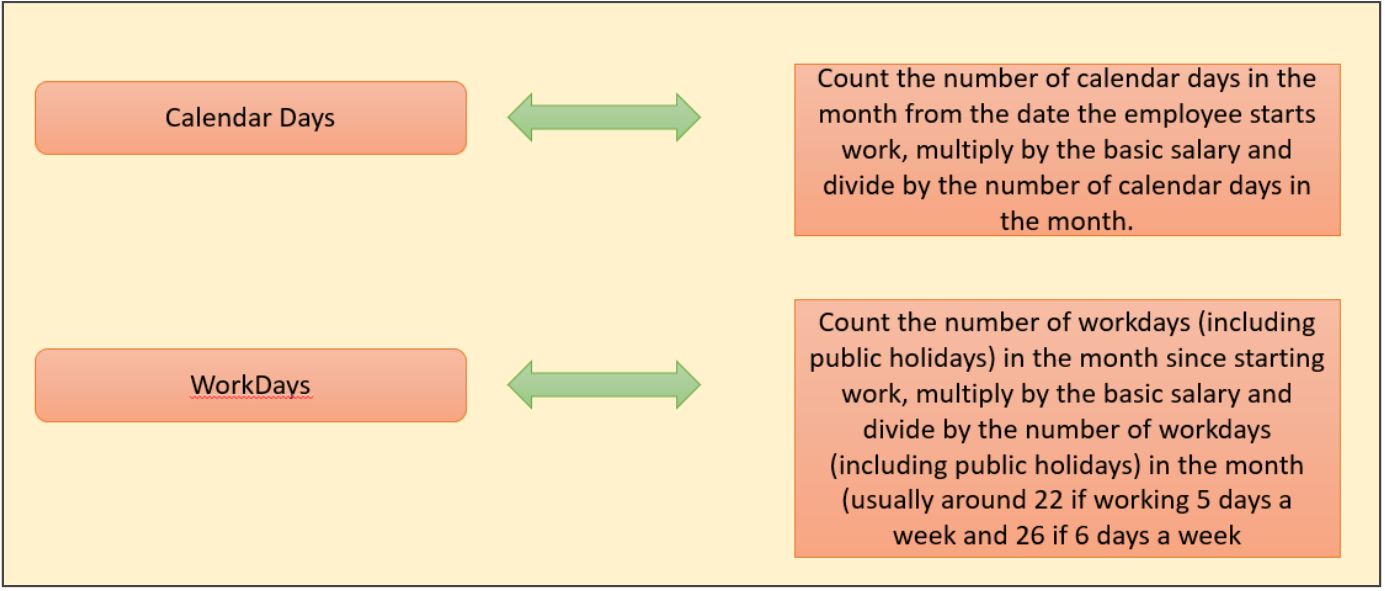

To calculate the daily rate you can divide the monthly salary by either of. There is a tripartite body known as the National Wages Consultative Council which is formed.

Salary Formula Calculate Salary Calculator Excel Template

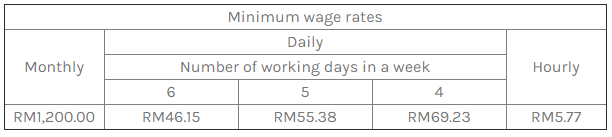

Hourly rateDaily rate Working hours RM 6923 8 RM 865.

. EMPLOYMENT ACT 1955 SALARY CALCULATIONS AND BENEFITS. Employees who earn monthly wages of RM2000 or less. Any manual worker regardless of monthly pay under a contract of service with an employer.

Divide your daily rate by normal working hours per day. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. If the employees salary exceeded RM2000 a month then the hours of work and overtime will be referred to the terms agreed under the employment contract.

3x the employees daily wages at the ordinary rate of pay. Working on Public Holiday. Do note that Employment Act only covers employee whose wages is less than RM2000.

Salary with fixed allowances X 12 months X years of services divided by 365 days. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020. Compute your hourly rate.

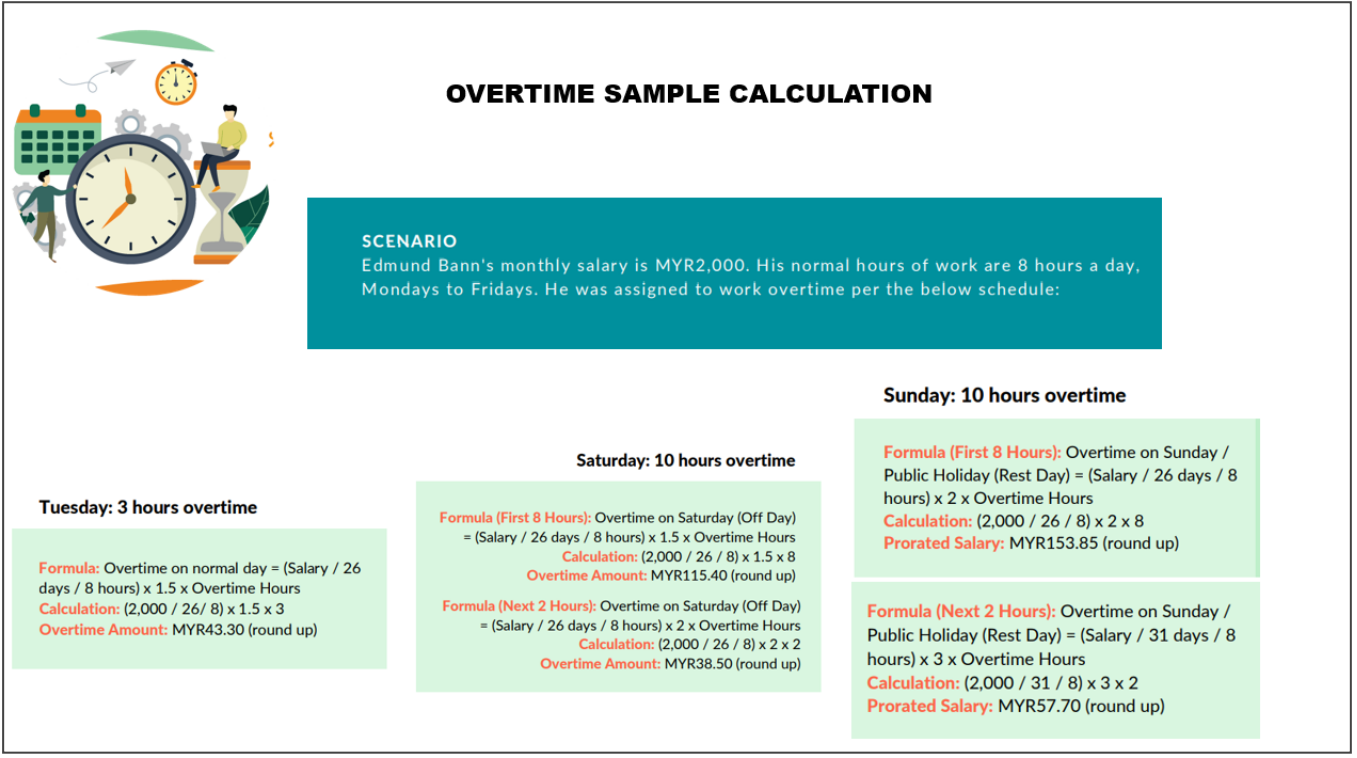

If the employees salary does not exceed RM2000 a month or falls within the First Schedule of Employment Act 1955 then we will refer to the Employment Act 1955. Any employee as long as his month wages is less than RM200000 and. Example of Malaysia Overtime Calculation.

RM 1600 26 RM 61. 11th Floor Block A4 Leisure Commerce Square Jalan PJS 89 46150 Petaling Jaya Selangor Malaysia. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -.

To do this divide the monthly salary by 26 days. A salary calculator Malaysia helps by simplifying the progress of employee salary calculation even based on the laws under employment act in Malaysia. According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier.

RM 5500x 12 calculation by percentage EPF Employee Contribution. Salary Calculator Malaysia for HRMS Payroll System. Divide your monthly salary by 26 to get your daily rate.

The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month. RM 615 8 RM 76. Working period of 2- 5 years 15 days salary per year.

To calculate the employees ordinary hourly rate of pay youll first need to calculate their ordinary rate of pay daily. RM 76 x 10 x 15 RM 114. Employment Act 1955.

Then take the daily rate and divide that figure by the number of hours to get the employees hourly rate. RM1800 RM26 RM6923. Monthly rate of pay26 days Section 60I 1A EA.

Ordinary. Any employee employed in manual work including artisan apprentice. RM 6000 RM 2500 RM 8500.

The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. The calculation formula for your ordinary rate of pay per day is your monthly salary divided by 26 days which is fixed and then the amount divided by 8 hours to get your hourly rate of pay. Payment for termination notice.

Under Subsection 3 of Section 60D of the Employment Act 1955 -the prescribed rates for work performed by for monthly weekly daily or hourly rate employees on a holiday are. For each company whether it is process by monthly fortnightly weekly salary required a salary calculation method in order to process employee salary calculation. Normal working day 15 Basic pay 26 days X 15 X hour of works.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month. Ordinary Rate Monthly Salary 26.

Hourly Pay Daily Rate of Pay Normal Working Hours. Find the number of working days in the current month. However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5.

However the Act only covers a number of select employee categories in Malaysia. Working period of 1- 2 years 10 days salary per year. So what about employees with a monthly salary that is beyond RM2000.

Despite the pay rate shall be 1 ½ times the hourly rate of pay of employees some employers found it rather economical to required employees to. Paying employee wages late. Overtime Pay Hourly Rate X Overtime Hours X 15.

Basic pay 26 days X 30 X hour of works. Working period of more than 5 years 20 days of salary per year. Multiply this number by the total days of unpaid leave.

Working days in Current Calendar Month including public holidays All Days in Current Calendar Month. Overtime Work on Rest Day An employee shall be paid at a rate that is not less than 2 times the hourly rate of pay. RM 5500 x 11 refer Third Schedule.

The Employment Act 1955 is the main legislation on labour matters in Malaysia. This means an average of about 4 hours in 1 day. In the case of an employee employed on piece rates who works on a rest day shall be paid 2 times the ordinary rate per piece.

Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. RM6923 8 hours RM865. The ordinary rate of pay on a monthly basis shall be calculated according to the following formula.

According to the Employment Act 1955 an employee is. Overtime is paid 15 times the hourly rate. Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include.

An additional 3 times hourly rate for each hour in excess of his normal hours of work. Module 2 PAYMENT OF WAGES CALCULATION. Fixed Number of Days.

Daily rateMonthly salary 26 RM 1800 26 RM 6923. Manual calculation of unpaid leave. To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings.

RM 3000 RM 2500 RM 5500 EPF Employer Contribution. 60 of Malaysia Employment Act 1955. Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020.

Anyone whose salary is not more than RM2000 per month under a contract of service with an employer.

Formul St Partners Plt Chartered Accountants Malaysia Facebook

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Everything You Need To Know About Running Payroll In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

Everything You Need To Know About Running Payroll In Malaysia

Employment Act 1955 Salary Calculations And Benefits Marm

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Employment Act 1955 Salary Calculations And Benefits Marm

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

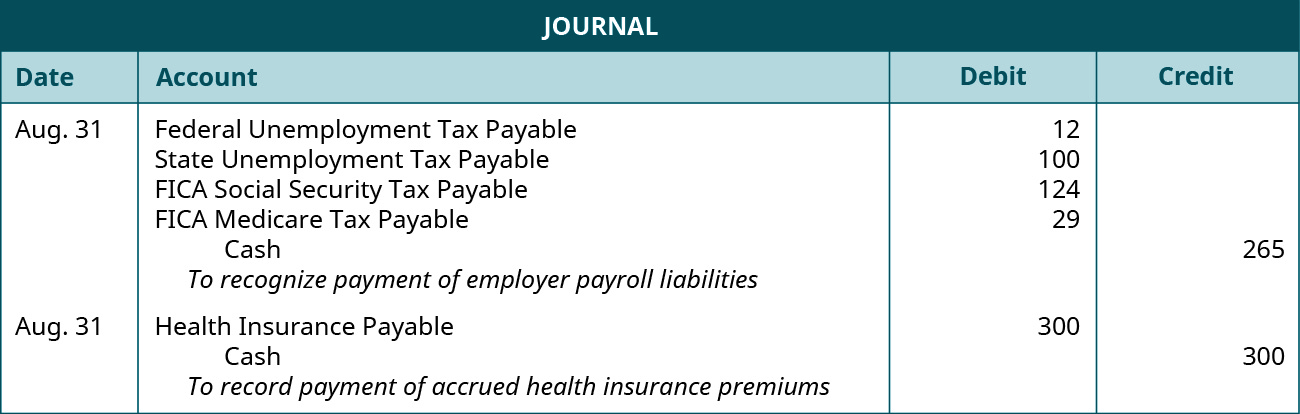

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay