Retail Prime Lending Rate RPLR. The loan eligibility is only an estimate based on the Total Monthly Commitment amount filled up in this calculator.

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Subscribe to us on Telegram for the latest insights and updates.

. An Adjustable Rate Home Loan is also known as a floating or a variable rate loan. As announced by the government back in 2019 the rates for a stamp duty increased 4 from 3 for properties costing over RM1 million. Calculate Home Loan Eligibility.

These are as follows. Every loan agreement tenancy agreement and property transfer document including the Sale and Purchase Agreement SPA that require stamping will be charged a fee or a transactional tax. The Malaysian population is estimated to be around 327 million people.

This is based on the Demographic Statistics First Quarter 2021 Malaysia that was released by the Department of Statistics Malaysia DOSMWith so many people living in this country how do we know if our assistance. Adjustable Rate Home Loan ARHL. Use this calculator to check your loan affordability with 17 banks before buying a house.

The interest rate in an ARHL is linked to HDFCs benchmark rate ie. HDB affordability calculator Loan affordability calculator House affordability calculator. The tax deduction can be availed for up to 7 years.

Deduction on Loan for Higher Studies. Malaysias first comprehensive Home Loan Eligibility Calculator It takes less than 2 minutes for results. Similar to the home loan interest income tax exemptions can also be claimed for interest on education loans.

Based on loan of up to 90 Residential 85 Non-Residential of property value. As per ones requirement and choice the customers can choose from different LIC plans ranging from pure protection to whole life endowment and. An education loan can be taken from any financial institution.

The results will help you decide an ideal range of house that suits your affordability. LIC policies offer a one-stop solution for all the insurance needs of the buyers. An HDFC home loan customer can choose between two types of interest rate options while availing a home loan.

Apply for a home loan right away. PropertyGuru Finance mortgage affordability calculator to estimate your mortgage affordability and maximum mortgage loan under MAS regulations covering limitations on TDSR MSR LTV Cash Downpayment. The maximum loan tenure is 35 years or up to 70 years of age whichever is earlier.

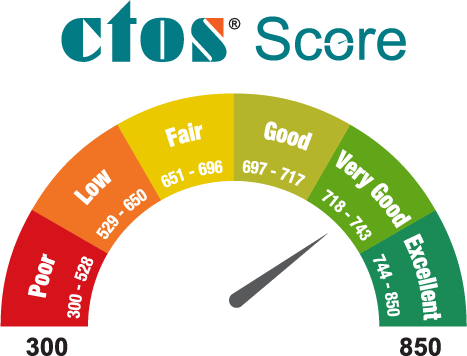

Home Loan eligibility is dependent on factors such as your monthly income current age credit score fixed monthly financial obligations credit history retirement age etc. Get the peace of mind by knowing all the details about your loan using HDFC Home Loan Eligibility Calculator. The Life Insurance Corporation of India LIC offers an extensive range of insurance products to cater to the various requirements of insurance buyers.

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Home Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

How To Use A House Loan Calculator In Malaysia

Malaysia Homes Maximum Loan Eligibility Calculator

Home Loan Eligibility Calculator Faiz Wahab

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

How Much Can You Borrow Based On Your Dsr

Property Affordabillity Calculator Home Loan Calculator Cimb

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

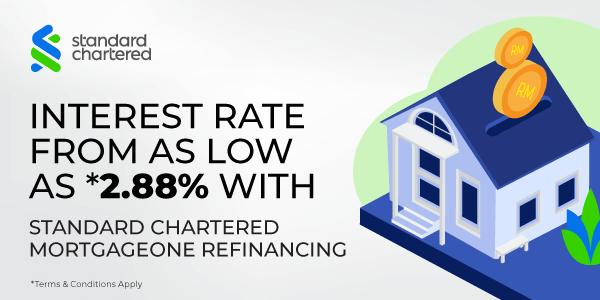

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Maybank Housing Loan Calculator Hot Sale 51 Off Www Ingeniovirtual Com

A Guide To Car Loans Interest Rates In Malaysia

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Home Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

Best Loan Calculators Loanstreet

A Comprehensive Property Tool In Malaysia Propsocial

Property Calculator Malaysia Apps On Google Play

Home Loan Eligibility Affordability Calculator